how much tax to pay on gambling winnings

Not sure how much to pay. Your gambling winnings are generally subject to a flat 24 tax.

Gambling Winnings Tax How Much You Will Pay For Winning The Turbotax Blog

After adding the cess.

. After adding the cess the overall tax rate is 3432 percent. Whats the tax rate on gambling and lottery winnings. Gambling and lottery winnings are taxed at your ordinary income tax rate according to your tax bracket.

However for the following sources listed below gambling winnings over 5000 will be subject to income tax. In the United States for example you would pay federal taxes on your winnings but the tax. But every time sportsbooks lose a 1100 bet they only lose 1000.

Its possible that gambling winnings when added to annual income could vault some players into a higher tax bracket. Marginal tax rate is your income tax bracket. You must report and.

For example if players win 150000 but lose 50000 in bets the taxable income allowed as a miscellaneous deduction. However if you itemize. Generally if you win more than 5 on a.

That means when Missouri residents pay their state income taxes they need to be aware they should report. That in turn would increase the percentage of state tax you have to pay not just on your gambling winnings but on your entire personal income. The answer to this question depends on the country in which you are gambling.

Its determined that gambling losses are a miscellaneous deduction. 1 crore are subject to a 15 surcharge over the standard rate. So if a bettor makes 10 wagers of 1100 each and.

For online casino and online poker services general sales tax law applies and gross gaming revenues the amount wagered by the players minus the winnings paid out are taxed at 19. Winnings may be reported on a W2-G. California sets several income.

Every time bettors lose a 1100 bet they lose 1100. If gambling winnings are received that are not subject to tax withholding you may have to pay estimated tax. Winnings that come over Rs.

Like most states Missouri considers gambling winnings taxable income. When you win a gambling win with a legal operator before giving you your winnings the operator will deduct 24 of the total taxes and provide you with a copy of the. If your winnings are reported on a Form W-2G federal taxes are withheld at a flat rate of 24.

If you didnt give the payer your tax ID number the withholding rate is also 24. Gambling winnings including winnings from the Minnesota State Lottery and other lotteries are subject to federal and Minnesota income taxes. Winnings from gambling can be taxable and should be reported on your tax return.

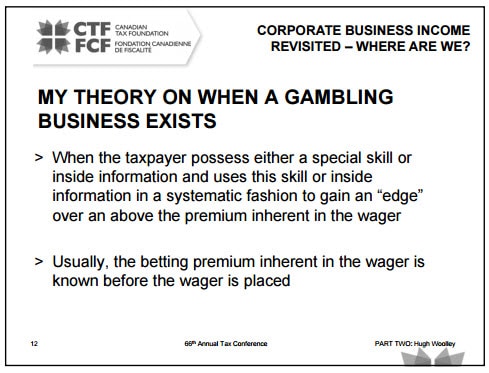

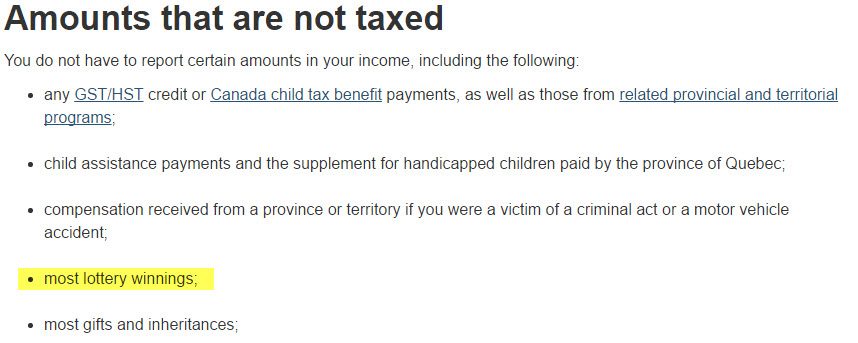

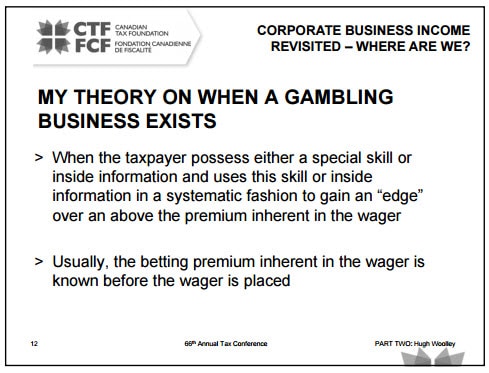

Are Sports Gambling Winnings Taxable In Canada Sportsbookbonus Ca

Are Gambling Winnings Taxed The Motley Fool

Are Gambling Winnings Taxable Taxation Portal

Gambling And Taxes What You Should Know 800 Gambler 800gambler Org

Paying Taxes On Gambling Winnings Do I Need To Pay Taxes On My Wins

Gambling Winnings Tax H R Block

How Are Gambling Winnings Taxed Cpa Firm Accounting Taxes

Us Taxes On Gambling Winnings Special Rules For Canadians

How To Use The W 2g Tax Form To Report Gambling Income Turbotax Tax Tips Videos

Are Sports Gambling Winnings Taxable In Canada Sportsbookbonus Ca

Gambling Winnings Tax 4 Things You Need To Know That

How Much Does The Irs Tax Gambling Winnings Howstuffworks

News Blog Casino Tips Tricks San Diego Ca Golden Acorn Casino And Travel Centerhow Are Casino Winnings Taxed Golden Acorn Casino

Are Sports Gambling Winnings Taxable In Canada Sportsbookbonus Ca

Online Gambling Taxes In Canada Current Legislation

Gambling Winnings Taxable In Canada What Can The Laws Do

Would I Report 2528 Or 754 As Gambling Winnings R Tax

How Are Gambling Winnings Taxed

Casino Gambling And Taxes How Does That Work Bestuscasinos Org